This excerpt is posted with permission from a report originally published by the Winston Churchill Memorial Trust, and can be found in its entirety here.

The marine sector is in a period of significant adjustment, as emissions management regimes and ambitious emissions reduction targets are applied variously for different ports, waterways and markets. This is not happening evenly, however it only takes a few significant jurisdictions to pressure markets to adopt low- emissions technology through increased taxation of traditional fuels, incentives for alternatives or restrictions on what can be used where (or a combination of these) to prompt the industry to make changes that affect markets globally. At the large end of the scale, ships already face restrictions and incentives at many international ports based on their emissions, such as the FuelEU Maritime Regulation that applies to all ships visiting EU ports regardless of their flag state, which is driving shipping companies and ship builders to revise their fleet plans. Australia has developed a Maritime Emissions Reduction National Action Plan (MERNAP), and the UK has recently released its Maritime Decarbonisation Strategy, including targets for 2030, 2040 and zero fuel lifecycle greenhouse gas emissions by 2050.

The highest emissions in the marine sector overall are from mechanical propulsion, and there are several low-emissions alternative technologies vying for a place in the marine propulsion market. In the shipping sector where ocean-crossing range is required, alternative fuels such as methanol and particularly ammonia appear to be favoured, with some diesel-electric ships also appearing, and Liquified Natural Gas (LNG) widely used as something of a transitional fuel. Many ships are also using ‘wind assist’ rigid wing-style sails to compliment traditional propulsion methods, reducing fuel usage. Some are even discussing the introduction of nuclear power for merchant ships, which I expect will alarm many familiar with the history of shipping and marine pollution incidents!

For smaller port-based, inland and coastal medium sized vessels such as tugs, tow barges, commuter ferries and small cruise ships where range requirements tend to be lower, different options are being explored including low-emissions drop-in fuels, electric and hybrid-electric, hydrogen fuel cell and hydrogen internal combustion engines (ICE). Many such vessels are already in service around the world using these technologies and many more are on order, with prominent examples including the 82m MF Hydra liquid hydrogen ferry in Norway, the Elektra hydrogen fuel cell push boat in Germany, and many electric and hybrid vessels. In Australia, Aus Ships Group has announced a project to build a solar electric ferry in Brisbane in partnership with Ampcontrol, and Incat in Tasmania is building the largest electric ferry to date, a 130m vessel capable of carrying 2100 passengers and 225 cars across the Rio de la Plata in South America, with a colossal 40 megawatt-hour (MWh) battery system driving eight electric jet units.

Those interested in decarbonisation of the shipping sector will find much information elsewhere, including from another 2024 Churchill Fellowship recipient, Andrew Dickson, whose upcoming report will look at global best practice zero-carbon shipping technologies and business models.

Marine Rescue NSW and our partner organisations do occasionally assist large and medium-sized ships with medical evacuations, however the vast majority of our SAR responses involve the smaller commercial and recreational vessels typically found on coastal and inland waterways in Australia, and for this reason I will focus on these smaller vessels up to 24m in length. Small vessels and propulsion systems in Australia are not immune from the influences of overseas market trends and regulations, as anyone who grew up like me wondering why my outboard motor was 9.9hp and not 10 may also have eventually figured out, and the products that will be viable for marine manufacturers to produce now and in the future will also be shaped by restrictions introduced in just some locations and markets. At the moment, traditional petrol and diesel propulsion methods dominate the Australian market by a significant margin and will likely do so for many years. If the products on display at Boot Düsseldorf are any indication, however, this may start to change in the future, with low-carbon ‘drop in’ fuels, hydrogen fuel cells, hydrogen ICE, hybrid-electric and particularly battery-electric propulsion making quite an impact on the European new boat market.

Drop-in fuels (bio and synthetic)

One simple way to reduce carbon emissions is to use alternative fuels with lower emissions in their production, supply and combustion cycles than petrol or diesel. There are a range of these under consideration and development for both petrol and diesel ICE systems, many of which will run in current ICE vessels without modification (hence the ‘drop-in’ label). This is a considerable advantage, as modifying or replacing vessels is potentially very expensive, and simply changing to a lower-carbon fuel in your current boat prevents the potentially very significant emissions that result from building new boats, or new batteries, and also prevents or slows the movement of older vessels to landfill, since much boatbuilding material such as fibreglass cannot be practicably recycled.

One option that is gaining ground as a diesel substitute is Hydro-treated Vegetable Oil (HVO), made from used cooking oil, animal fat residue from food processing, tall oil residue from manufactured wood processing, and agricultural products, then hydrogen-treated to meet emissions standards. HVO burns cleaner than previous bio-diesel products with lower sulphur content and less susceptibility to bacterial contamination, and it reduces carbon dioxide emissions by up to 90% while having around the same nitrogen oxide emissions. It can be used in most diesel engines already in service, though it is around 6% less energy dense and some engines will require new hoses and seals to be fitted. It is currently produced in volume and available in several markets in Europe and North America, though currently more expensive than diesel in markets lacking incentive schemes. There are also other biodiesel products available such as such as Fatty Acid Methyl Ester (FAME), which tends to cost more than HVO and has particular storage requirements due to its susceptibility to microbial growth, but does have safety advantages with a higher flashpoint than HVO or traditional diesel.

In petrol boats methanol is widely used, mostly as an additive with petrol, though engines can be modified to burn straight methanol. There are some well-documented downsides to methanol, particularly where a boat is not used regularly and the methanol sits in the tank. Other biofuels and synthetic fuels are also being looked at, sometimes as additives to traditional fuel, sometimes in mixes with each other or with hydrogen, sometimes in existing engines and sometimes in modified/purpose-built ICE engines, but these are yet to be widely available. Suzuki Marine recently conducted an eco-fuel ‘run to the capital’ in which a Suzuki outboard powered boat undertook a 940-mile voyage from Jacksonville to Washington DC using a blend of petrol and bio-ethanol, reducing emissions by a claimed 30%. Given Suzuki Marine has not released an electric outboard model it may be that at least one major outboard manufacturer is betting on drop-in fuels.

It’s not all good news with drop-in fuels, as many of them still produce carbon emissions, though less than traditional fuels, and they tend to be both more expensive and less energy dense than petrol or diesel, requiring more of it at a higher price – though they may be a much cheaper option than a new boat or new propulsion system. The emissions and overall environmental benefits of such fuels will depend in large part on where and how their raw materials are sourced or grown, and where and how they are made and transported. Like an EV plugged into a diesel generator, a boat using low-emissions fuel that was grown using diesel farm equipment, processed in a factory powered by gas or coal-fired power, and delivered in a diesel truck would rightly draw some critics. In the case of biofuels, it’s also important to consider whether it is sourced from palm oil plantations or other locations established at the cost of critical ecosystems or habitat, or if its production reduces the agricultural land available for feeding the global population.

Still, at a time when many talk of an impending climate crisis, every option must be on the table, and the fact that bio-sourced and synthetic drop-in fuels can be used in the boats we already have must count as a significant point in their favour.

Hydrogen (fuel cell and combustion)

Hydrogen can be used in two quite different ways for vessel propulsion, it can be burned in an internal combustion engine, or it can be used in a fuel cell to generate electricity to power electric motors. Both options are being explored for marine propulsion, and both have their advocates.

One prominent example of a hydrogen combustion approach is a 5.6L V8 prototype hydrogen-fuelled outboard motor developed by Yamaha Marine and displayed at several international boat shows in recent months. I was able to see footage of this motor running at a testing facility in Alabama, but it remains a prototype and it is not yet clear what products it might lead to. Hydrogen combustion has some drawbacks, as engines such as this are quite complex like any internal combustion engine, with many components and presumably servicing requirements. Hydrogen combustion would appear to have range limitations, too, as hydrogen gas, while light weight, takes up a lot of space, and the Yamaha prototype vessel has a range of only 46 miles from three 240L cylindrical tanks holding a total usable 23.7kg of hydrogen at 700 bar or 10,000 psi.

Hydrogen fuel cells powering electric motors appear to be more favoured for vessel propulsion, for reasons including quiet operation, low maintenance requirements and higher efficiency allowing for greater range for the same amount of hydrogen stored. There are many hydrogen fuel-cell vessel prototypes around the world, and some already in commercial operation, such as the Hanaria in Japan, a hybrid hydrogen-biodiesel ferry. Working prototypes include a Yanmar hydrogen fuel cell powered commercial vessel (discussed in detail below), and leisure vessels demonstrated by companies such as Hynova in France, Lurssen in Germany and Dhamma Blue in Spain. Closer to home, McConaghy Boats and Emirates Team New Zealand have built five 13m ‘Chase Zero’ foiling electric support vessels powered by Toyota hydrogen fuel cells, with the latest used during the 2024 Americas Cup campaign and capable of over 50 knots! A hydrogen fuel cell-powered RHIB named H2Ocean is currently undergoing sea trials in New Zealand, built by King Watercraft and Fabrum, and is intended to be viable for commercial use.

One of the main challenges for hydrogen propulsion is delivery and supply, with few hydrogen fueling stations, especially on waterways. This may be a significant barrier to adoption, especially since its main competitor, electricity, already has supply infrastructure in place and is available at marinas, homes and boatsheds around the world. Hydrogen supply infrastructure is being developed, but slowly and unevenly, mainly in locations where a hydrogen vessel and supply infrastructure have been developed together, such as the Elektra project in Germany. Without this coordination it’s something of a chicken-and-egg situation: who will develop a hydrogen boat where there is no hydrogen supply, and who will develop supply infrastructure where there are no boaters using it? In some prototype vessels the hydrogen tanks must be taken out of the vessel and transported to a supply location, adding some complexity and risk to each refuel.

There are other challenges, too, such as hydrogen storage, and here there are two choices. Hydrogen is a gas at normal temperatures, which is easy enough, but large volumes are required to provide acceptable range, even at the high 700bar pressures typically used, as with the Yamaha prototype mentioned above. Hydrogen can also be stored as liquid with 800 times less volume, but it must be stored at -253°C, a complex engineering challenge in itself, and for this reason most prototypes are storing hydrogen gas. Safety and public perceptions of safety are another challenge, as hydrogen stores a lot of energy, can be explosive, and has the smallest atoms that can leak through the tiniest fuel line fitting leak. Hydrogen systems require high quality regulators and fittings capable of handling high pressure, skilled installers, and ventilation systems. One advantage of hydrogen in terms of safety in the event of a failure is that it is lighter than air, and emergency vents can release hydrogen high on the vessel so it can harmlessly go up into the atmosphere, possibly even if it has ignited – it will send a jet of fire up vertically, and the show will likely be over quickly. Another advantage is that existing fire suppression technology works effectively on hydrogen.

The Yamaha prototype V8 hydrogen combustion outboard on display at Boot Düsseldorf

A final challenge of hydrogen is generating the hydrogen itself, and despite being the most abundant element in our universe this is not so easy, as almost all hydrogen on earth exists in compounds with other elements. There are several ways to generate pure hydrogen, but some use fossil fuels and result in carbon emissions, and some methods such as electrolysis which do not result in emissions currently require more energy to generate the hydrogen than the energy stored in the resulting hydrogen. So, the source of your hydrogen will be an important factor in just how sustainable your hydrogen propulsion system is, and clearly there is work still to be done (but then, electricity often also comes from non-sustainable sources). One idea is to generate hydrogen from surplus renewable energy, then store it for when it is needed, and it does store well over the long term if well-contained. There is also every likelihood that new methods of generating hydrogen will be developed in the future, perhaps even methods that can be safely used at homes or at marinas without the need for the building of complex supply infrastructure. Let’s not forget, there is abundant hydrogen in the water right beneath our hulls, we just need a method to extract it as we go, and engineers at the Massachusetts Institute of Technology have developed a process to create hydrogen from sea water, caffeine and (of all things) aluminium beer cans – and while I would never encourage alcohol consumption on the water I can’t help but think this holds promise for Aussie boaters!

In the land transport sector use of hydrogen fuel cells has grown in many kinds of vehicles, so it does seem likely that this technology will continue to grow in usage in the marine sector, and not just for propulsion. Fuel cell generators for house power on vessels are already in development, promising clean, silent house power which will appeal to many vessel and marina operators (and those seeking tranquil anchorages). Despite being a clearly promising and rapidly evolving technology, for the moment the challenges with hydrogen propulsion systems, and the high cost, will likely mean we are a way off seeing hydrogen boats and propulsion systems produced at scale, and while opinions vary over whether it will ever overtake electric propulsion, most of the experts I spoke to believe it will be part of the mix in our decarbonised future.

A Chase Zero hydrogen boat built by McConaghy Boats and Emirates Team New Zealand. Photo: McConaghy Boats

Battery-electric propulsion

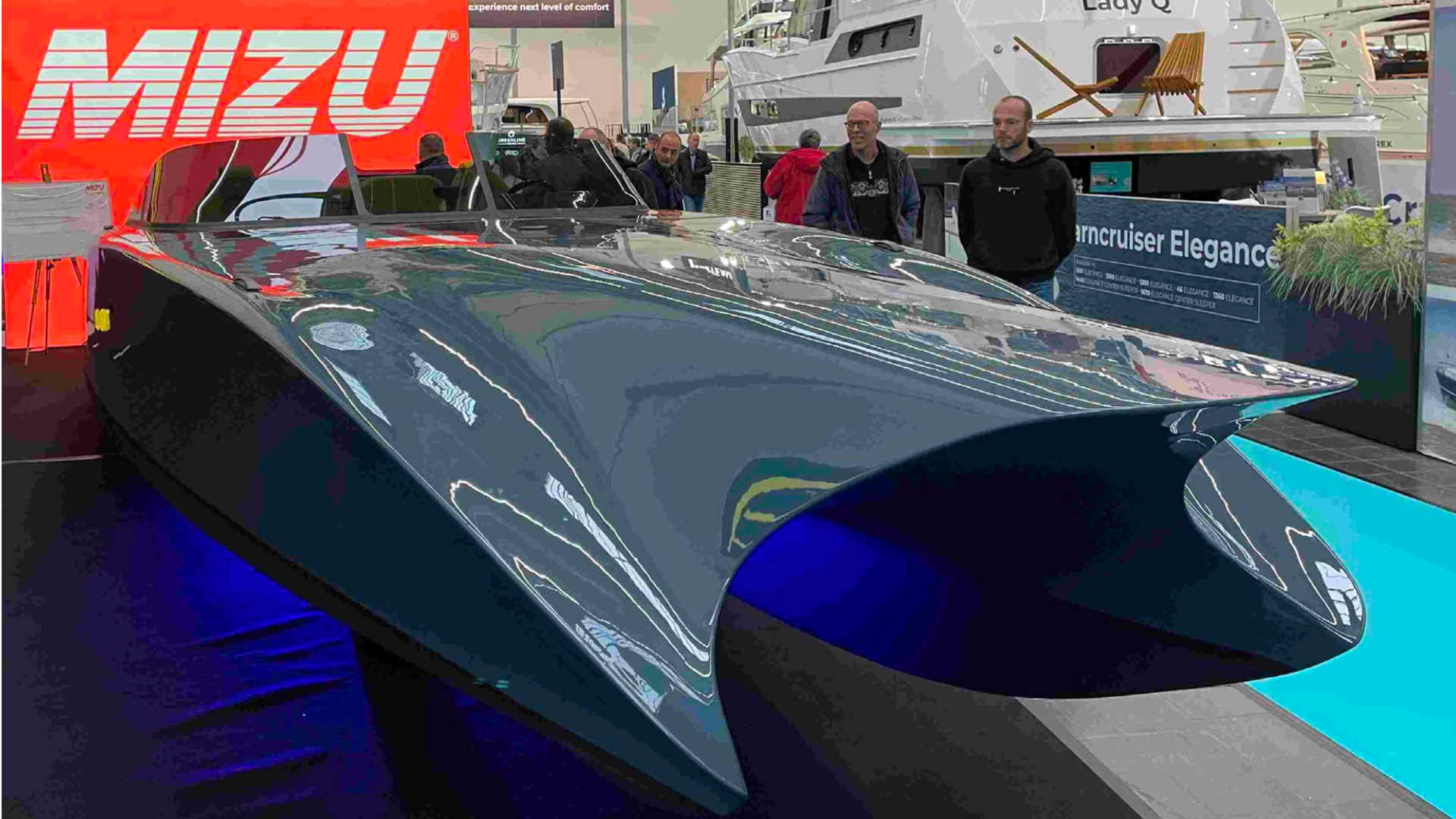

The alternative propulsion technology that appears to be making the most impact on recreational and small commercial vessels is battery-electric propulsion, especially if judged by what is displayed at the major boat shows. There are many electric boats and electric outboards already available, and electric boating media company Aqua Lectric has identified close to 100 companies producing and marketing electric boats and propulsion systems globally. The European in particular has embraced electric propulsion, in part due to the growing number of European waterways where ICE vessels are restricted or prohibited, and increasing numbers of boat owners are embracing electric propulsion not just for environmental reasons but for amenity reasons such as simplicity of operation, near-silent running, lack of fumes and, in the case of electric foiling vessels, their comfortable ride.

Battery-electric boats are not a new concept and were actually quite popular around the turn of the 20th century before petrol and diesel propulsion came to dominate the sector. Electric motors came into use as auxiliary propulsion for trolling and manoeuvring while fishing or powering canoes and small dinghies with a small conventional battery, with the notable exceptions of Duffy Electric Boats in California and Marian Boats in Austria who have been building larger electric boats for decades.

Some of the many small electric outboards displayed at Boot Düsseldorf 2025

Over the past decade or so this has changed rapidly, as emissions have become a focus of both regulators and boaters, and as battery technology has evolved rapidly, with lithium batteries that can store a lot more energy with lower weight becoming more practical and affordable. Brands such as E-Propulsion and Torqeedo have become well-known, with electric outboards in the 2-5hp class selling in similar or greater numbers than their ICE equivalents, and new and larger electric outboard models introduced each year over the past decade. Many other manufacturers have joined the market, and electric outboards are now available in every category, including 300hp high-performance models from Explomar and Evoy, which gain considerable attention at boat shows and can be seen in online videos providing very high performance indeed. Established manufacturers like Mercury have invested heavily in electric propulsion, offering electric outboard model lines, and the recent acquisition of Torqeedo by Yamaha is perhaps another indication that large marine corporations see electric propulsion as part of the mainstream future of boating, with some in the industry expecting further consolidation of the market in the future. This may help public acceptance, as when large and well-known brands are behind electric propulsion products people will have confidence in the technology, including its safety and the likelihood of ongoing warranty and parts support.

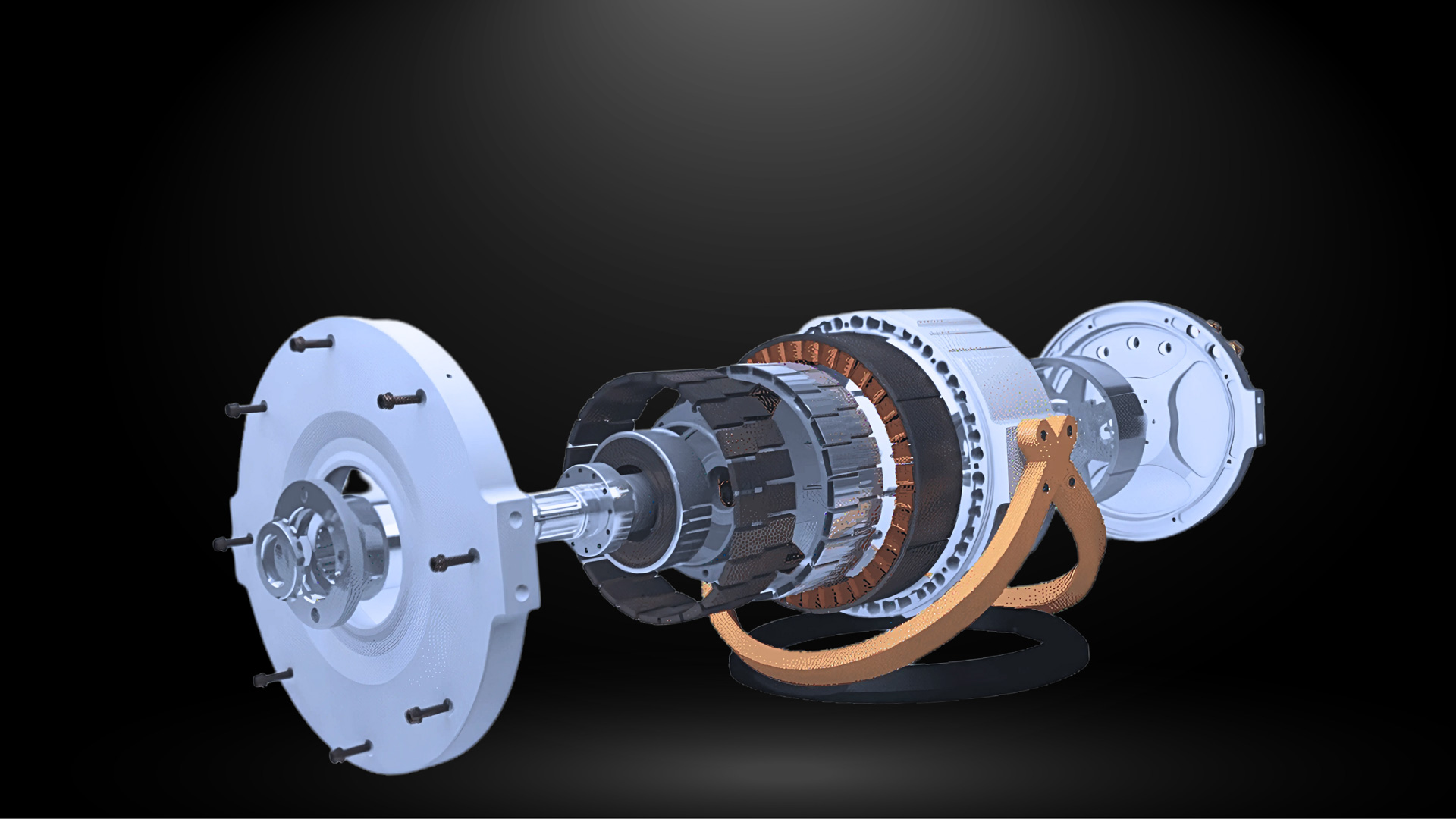

Inboard electric propulsion units are available too, with companies such as E- Propulsion and NT Systems offering smooth, quiet, high quality inboard models in a range of power outputs, and many boat builders are now offering or even specialising in electric vessels. It was seeing one such boat, the Candela C8, on display at the Sydney International Boat Show that set my mind to thinking about this research, resulting in a visit to the Candela factory in Stockholm (see below). There are many other companies, too, including major players such as Rand and Four Winns that now offer electric propulsion as an option, and well as many smaller companies dedicated to electric boat production such as Enautic, Fibre Boats and Genevo, just to name the Australian ones I’ve found. In the commercial sector, companies such as Candela and Artemis Technologies already have fully electric commercial ferries and work boats in operation around the world (see below), and Green City Ferries is already in operation in Sweden with the fully electric Beluga 24 (and a hydrogen fuel cell version of this vessel in development).

In Sydney the NRMA-owned My Fast Ferry has been operating a small electric ferry between Barangaroo and Pyrmont since 2022, and in New Zealand, Vessev has a 9m passenger ferry in commercial operation, with larger vessels planned.

Meeting with Adria Jover, CEO of the International Electric Marine Association (IEMA), he agreed that commercial vessel operators are embracing electric propulsion at a faster rate than recreational boaters, as commercial vessels are typically used much more often than recreational vessels, and the more an electric boat is driven the more quickly the higher initial cost is offset by lower running and maintenance costs. Indeed, electric propulsion is already the more economical choice for many commercial operations where trips and therefore range requirements are predictable and the vessel returns to the same location daily for charging.

Electric vessels are in use as wind farm service vessels, and are being built and marketed specifically for port security and short- range military purposes, such as the Canadian-built Voltari Patrol 26 RIB. Electric propulsion is suited to security and compliance patrols where range requirements tend to be low but fast acceleration, silent operation and minimal heat signature may be advantageous. Electric propulsion will also be valued by research organisations and eco tour companies for their near-silent operation, allowing them to launch small electric vessels from larger ships to get close to wildlife or sensitive areas. Having now experienced several electric boats I see many potential applications, from water taxis to aquaculture and from island transfer vessels to marina tenders.

Among recreational boaters, I expect electric propulsion will be embraced more slowly and not evenly across the range of vessel types. Electric propulsion does make perfect sense for displacement day boats and as auxiliary propulsion for sailing vessels where speed is kept low, range requirements are moderate and battery capacity can be modest (and therefore affordable). For those who expect to travel at planing speed for any distance, however, the cost and weight of the battery required will be a significant barrier – at least until costs and weights of batteries are reduced by expected future technological advances. Illustrating this is the fact that Canadian company Voltari used its high-performance electric speedboat, which is capable of over 50 knots and has a 142kWh battery, to travel from Florida to the Bahamas, a distance of 80 nautical miles. This is a trip that Justin Dalinger of Aqua-Lectric told me is something of a standard test or benchmark for boaters in Florida, which is the US state with the largest boating market, since many expect (or hope) to make this trip someday. The problem at the moment is that the Voltari boat, despite its impressive speed potential, had to make the trip over 20 hours (so averaging around 4 knots) in order to make the distance.

So, those of us who want to head out at speed to our favourite fishing spot will not be repowering our runabouts with electric propulsion systems anytime soon, at least until battery density improves to the point where it can meet our speed and range expectations or, I suppose, until regulatory or social pressure in the face of climate change leads us to moderate our expectations. Many industry experts I spoke to told me their data indicates most Florida boaters never find time for the Bahamas trip, and most of the rest of us also don’t really need the range we think we do, so expectations are a key part of acceptance of this technology.

The impressive 300hp Explomar outboard on display at Boot Düsseldorf. Unlike most small electric outboards that have the motor in the lower leg and directly cooled by the water, larger models like this tend to have the motor in the upper unit, with heat exchangers in the lower leg or cavitation plate and closed glycol cooling systems.

There will be early adopters who have the means and are enthusiastic about the technology, or enjoy the amenity benefits of near-silent boating, or who just enjoy the attention some electric boats, especially the foiling ones, will bring (and many new electric boats feature hydrofoils, as will be explored below).

A beautiful classic-styled Marian electric boat on display at Boot Düsseldorf

There are several advantages of electric propulsion, and many possible motivations for choosing it. Obviously for many the main advantage is their environmental benefits, and the fact that an increasing number of jurisdictions and waterway managers are only allowing low/no-emission propulsion. Then there are the amenity benefits of near-silent operation, simplicity of use, lack of liquid fuel to spill or create fumes, and for some at least the soft ride that comes with foiling boats. Electric propulsion systems are also simple and reliable, with few moving parts and few maintenance requirements, and they are very economical to run (eventually offsetting the higher initial cost). Most of the models I saw do not require sea water circulation for cooling, but either have the motor in the lower leg where it is directly cooled by the water, or use closed glycol cooling systems with heat exchangers. Gearboxes can be simple and robust with no need for a reverse gear mechanism as the electric motor can easily run backwards with reversed polarity.

The high cost of electric propulsion systems, as well as many of the other disadvantages, relate not to the electric motors themselves, but to the batteries that power them, which are expensive, heavy, complex, difficult to recycle (at least for the moment) and, while very safe in high-quality marine applications, they are (like combustible fuels) not entirely without risk. Given the number of electric propulsion systems now commercially available, evaluating just how risky electric propulsion systems are, both to users and marine rescue responders, was one of the key questions driving my research, and will be discussed at length in a later section of this report.

While there are many different battery chemistry options to choose from, almost all commercially available electric propulsion systems use Lithium Iron Phosphate (LFP/ LiFePO4) batteries. LFP batteries are slightly less energy dense but much safer than many of the older battery types such as Lithium Nickel Manganese Cobalt Oxide (NMC) batteries that are still used in some applications. LFP batteries bring significant advantages in terms of safety and stability, being able to be safely charged and discharged more rapidly and having a significantly higher thermal runaway threshold temperature, 270°C instead of around 150-200°C for NMC batteries, and LFP batteries also release significantly less harmful gas and vapour in the event of a fire. There are new battery technologies in development, too, that promise advantages including the critical one of higher energy density, such as Lithium-Titanium and Solid- State batteries, though whether these will also bring new disadvantages or risks is unclear at this stage. Lithium-free Sodium-Ion and Red Ox Flow batteries are also being looked at, and while these are less energy dense than lithium battery chemistries, they are purported to be safer and potentially more affordable. In the future it may even be possible to store energy in ‘structural batteries’ within the composite materials of our boat hulls, with research underway at the University of NSW on this appealing possibility. For the moment, though, LFP batteries at 48, 96 or 400 volts seem to be the industry standard, with low voltages mainly used in small electric outboards and higher voltages being used in the larger and more complex systems. These batteries are often encased in IP67-rated housings, meaning they can be submerged for at least one hour with no water ingress, often surrounded by fire-resistant barriers, and always protected by a Battery Management System (BMS), which is a critical component of any electric propulsion system. The quality of the battery, BMS and charging system, and the correct installation of the system right down to the cables and connectors used, are critical to the performance and safety of the system. Electric propulsion companies have gone to great lengths to ensure their battery suppliers are trustworthy and use high-quality cells and other components in batteries, and a few even manufacture the batteries in-house for this reason.

The weight, shape/bulk and cost of batteries is also a barrier to retrofitting electric propulsion systems to existing boats, and while such installations are complex and rather rare at the moment, there have been quite a few done successfully on many different styles of boats. Canal boats, for example, are increasingly being fitted with electric propulsion systems as they have ample space for batteries and solar panels, and do not need to travel at speed. Electric systems also make sense for yacht auxiliary engines, tenders and displacement day boats. Most planing boat owners, though, will likely not be switching to electric until battery technology, costs, and our range and performance expectations converge, though some will make the switch for amenity reasons as noted above. NT Systems in Slovenia has successfully converted a beautiful 7.47m classic wooden speedboat to inboard electric propulsion using their beautifully engineered C160 inboard electric motor, and watching the video (included in the reference list below) I can see the appeal.

Hopefully as commercial operators increasingly adopt electric propulsion, taking advantage of the savings it brings in high-usage applications, costs will come down for the rest of us. Experience in other markets, and our own experience with Electric Vehicles on our roads, has been that acceptance of electric transportation has accelerated rapidly once it has gained a toehold, and the International Electric Marine Association anticipates markets like ours might see 10% of recreational vessels and 25% of small commercial vessels powered by electric propulsion in around ten years. That doesn’t seem overly ambitious or unrealistic to me given the products I have seen and experienced during this research, and it would only take one breakthrough in battery technology, either reducing costs or increasing energy density (or preferably both) to change the economics of electric boating for many of us. What I can say is that when I experienced electric boating for myself as I will recount below, I immediately ‘got it’ and enjoyed the feeling of moving through the water in near-silence, and I think when others experience it they will enjoy it, too.